Traditional 401(k), Roth or both?

Simple. Custom. Effective. Retirement Plans

Roth 401(k)

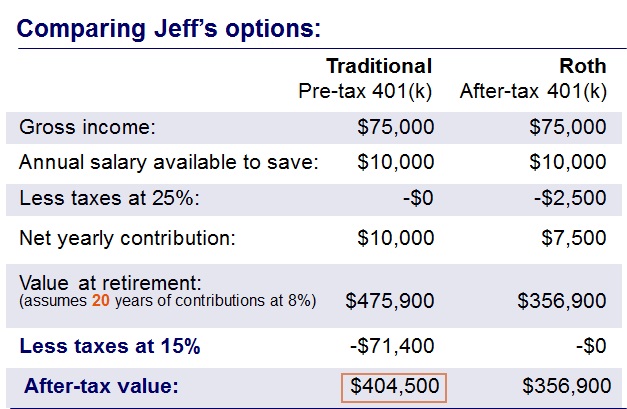

Your deferral goes in after-tax; earnings grow tax free; tax free withdrawals as long as certain conditions* apply.

Traditional 401(k)

Your deferral goes in pre-tax; earnings grow tax deferred; tax are due upon withdrawal.

Your 401(k) contribution limits in 2024, whether they're Traditional, Roth, or a combination of both - are the same and can't exceed $20,500 ($27,000 if you are 50+). For illustrative purposed only. These hypotheticals are not intended to suggest a particular course of action or represent the performance of any particular financial product or security.

Which one is right for you?

" I am all over Roth."

Just starting a career

Relatively lower income tax bracket

Believes income (and taxes) will increase in the future

Isn't worried about current tax deduction

"I'm more the traditional type."

· Can't really afford more taxes now

· Needs more tax deduction

· Doesn't expect to be in a higher tax bracket when he retires

"Both, please."

· Isn't sure whether taxes will be higher or lower in retirement.

· Wants to diversify tax strategy

· Still wants a current income tax deduction.